Nibbling at Bitcoin: A Savage Journey to the Plan B Forum, San Salvador

Orange is the new orange

As you may have heard too many times, Bitcoin was invented in 2008 by Satoshi Nakamoto, a pseudonymous person. It didn’t have much impact at first, but within a few years became notorious for its use as the currency of choice on the Dark Web, where illegal drugs could be purchased from online sellers and delivered to your door. Silk Road, the most famous Dark Web marketplace, was taken down in 2013, and its founder, Ross Ulbricht, aka “Dread Pirate Roberts” jailed for life in 2015 for ordering murders for hire and pardoned a few days ago. The usage and price of Bitcoin (BTC) and other cryptocurrencies have grown enormously since that time. Despite the constant buzzing of swarms of startups, the use of crypto for payments has not been widespread. It’s mostly used as a “store of value”. That’s promoter-speak for speculation. According to Forbes, the global market cap of cryptocurrency had grown to 3.61 trillion USD as of January 26, 2025.

What else happened in 2008? Nothing much, just the near-collapse of the under-regulated banking system in the USA. The crash was hard and effects fell hardest and longest on borrowers and workers. Those who held onto their assets saw their value recover and then climb to new heights. Result: increasing inequality, and accelerated mistrust of society’s institutions, see also our recent election. No wonder people are looking for a new way to get rich, or even get by, when jobs promise ever less security and housing becomes less affordable for those without “generational wealth” (that’s the polite term for class).

In some circles this would be a confession: I can’t quite quit Facebook. It keeps me connected to friends and family and events, and I’m used to pulling on my hip boots for a stroll in the river of falsehoods for my daily constitutional. Just before Christmas it floated me a bone: an ad for Bitcoin conference in El Salvador, the only country where it’s actually legal tender. I saw it the very day that the IMF was telling El Salvador’s crypto-crazed president to collect their taxes in USD not BTC or their loans would be called. Said government had made Bitcoin legal tender a couple years ago, and adoption has dropped from minimal to infinitesimal. I was instantly interested. I’ve worked in IT in the financial sector for a while and could expect to have a laugh at weasel-wordy hype for a technology already had a great future behind it. I’m always itching to travel somewhere Spanish-speaking and a bilingual conference would anchor a fun long weekend. Ridiculous? Hell, yeah! I recruited my friend Simon. He’s a fellow financial IT veteran with a nose for bullshit and a keen sense of absurdity. We failed abjectly to talk each other out of this: A work-adjacent super-fun road trip! I had to pack a USB’s worth of acronyms, currency names, protocols, scandals, and nicknames for technical issues in my head before I packed the insect repellent, oral rehydration packets, T-shirts, and adapters. And that was a lot of fun. Although I have to force-feed myself the information I need for my ‘real’ job, I found myself rapidly absorbing this strange brew of two-edged tech and self-serving politics. But would my interest, compound?

The promo material for the conference was so minimal that I had some doubt it would happen, but the registration fee was small enough to lose, and there are volcanoes, beaches and other cool stuff to enjoy, conference or no. Two weeks before we left, the background for the conference became clear: this time, my umpteenth Google search showed a reference to “Plan B” from Tether, the leading stablecoin company who appears to be the main sponsor. A couple days after, the news broke that Tether is moving its headquarters and some operations to El Salvador and possibly building a skyscraper there as well. The picture came into focus now; it’s some old-fashioned quid pro quo.

Our flight down included the best of travel companions, lots of empty seats. The immigration officer smiled when I told him I was there for a Bitcoin conference. “Es la futura!”. Our friendly and functional 3-star hotel was in San Salvadora’s San Benito neighborhood, aspirationally called the “Zona Rosa”. It’s just a 2-minute walk from the conference site at the Museum of Modern Art.

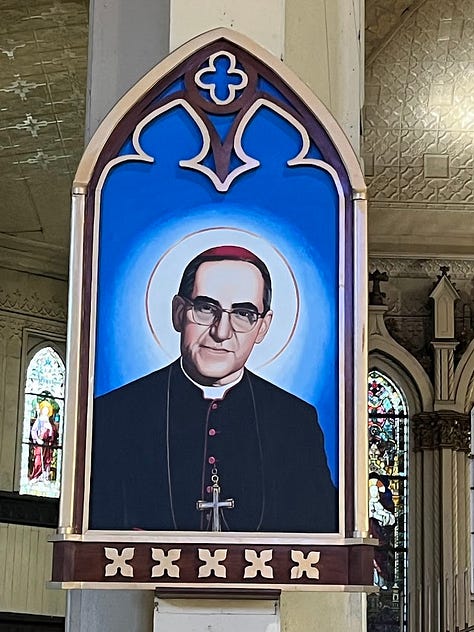

We were there a day early for some acclimatization. How does it feel to be in a country where people are reportedly delighted by a president who has locked up two per cent of the entire population for gang membership? And how much would I be able to use my Spanish? We joined a walking tour of the downtown historic center. Our guide Lisbeth had a perfect American accent learned from TV series. The other three travelers on the tour included a chatty engaging Aussie with no clear profession, and an English backpacker nearing the end of eleven years on the road, and a very tall and very quiet man with big earrings who kept wandering off. Lisbeth told us that when President Bukele made Bitcoin legal tender and gave every Salvadoran 30 dollars’ worth, everyone just spent it as US dollars, immediately. She might have held on and would definitely have profited but “there was no education about it, they just gave to us one day”. She was happy to tell us that it’s now safe to walk through the street market that led to the zocalo. Daily life is no longer stifled by gang violence since tens of thousands of MS-13 and other criminals were summarily locked up for indeterminate terms a couple years ago. I was struck by the beauty of the 70’s vintage El Rosario church (pictured) and impressed by the constant images of Archbishop Romero, assassinated by the El Salvador military in 1980 at the beginning of their civil war. It was a surprise/not surprise that the authoritarian government has appropriated the hero of resistance to the country’s ruling class. The tour ended at the beautiful new National Library, built by the Chinese. We all repaired to a sleek modern coffee shop with a prominent ‘₿’ logo. I was unable to spend any crypto since my PayPal app would not work with their system. But my pour-over was delicious.

We shared a cab back to the hotel zone with the English guy. He chattered a lot but evasive as to why he’d been on the road for eleven years or why he was about to end his odyssey. And why should he tell me? I noticed he was still wearing the wristband from the Viajero hostel in Cali, Colombia where I’d stayed in 2023. The further you go, the more likely you are to meet yourself.

After dinner we headed to the bar at the Sheraton to feel the pre-conference vibe, and sure enough there were plenty of energetic youngish gringos in the house. Karaoke lyrics scrolled on a large screen at the end of the long wood bar, but the music was turned down low. Our conversation about “what would we sing here if we had to” was joined by Kurt from New York and Noah from Austin, first about Lou Reed vs. Leonard Cohen vs. Tom Waits, but soon enough about Bitcoin. Noah was on his eighth trip to El Zonte, also dubbed “Bitcoin Beach” on behalf of his crypto mortgage company, and Kurt ostentatiously wouldn't say why he was in the country. “What, you think I’m a sex tourist?” he asked, as if to humble-brag that he might have something to hide. I allowed only that I worked for a large U.S. financial organization that I’d rather not name. We then got into a friendly back-and-forth about some of the major issues with Bitcoin adoption. Kurt insisted that fiat money (currency issued by a government) undermines freedom through inflation, though he didn’t have a clear answer to my riposte that gold is after all just a commodity. A major objection to Bitcoin is the environmental cost of the electricity used to ‘mine’ the original coins and then to perform the cryptographic calculations to verify and propagate transactions.This is called “proof of work” and could easily be replaced by a simpler calculation called “proof of stake”.However, this would require a certain amount of centralization, which is anathema to the true believers in BTC as a decentralized leaderless open-source community.

It's actually the large players who profit from energy-intensive mining operations that have the most to gain from the proof-of-work status quo since the cost creates a barrier to entry. Their answer to the enormous waste of energy was “look at the waste of energy by the current financial industry”. Well, not really, their direct energy cost is not the problem, it’s the grotesque misallocation of resources. But the issue of inequality is most un-interesting to most Bitcoin enthusiasts in the US at least. If they’re interested in anything beyond speculative profit, it’s privacy and liberty. Both these guys sounded like the existence of a federal government was an affront so grievous that any price should be paid to undermine it. Mostly we were showing each other that we knew these topics and could just point to the arguments. Swell fellows we are, who could pretend to have reasons not to look too closely at each other’s bona fides. Crypto can allow for new forms of identity, and some players at the conference would ‘brand’ themselves to emphasize that. l expected ‘liberty’ to mainly mean the liberty to avoid taxes. Would the conference host opposing views? Would there be any debate? Would there be snacks?

We got our first answers very quickly as we crowded into the Sheraton Presidente and our badges checked frequently by lots of friendly young local staffers. The place was packed, and fully funded. The $29 entry fee for Salvadorans enabled lots of local people to come. To my surprise, foreigners like me were probably a minority. The hotel ballroom was packed with nearly a thousand people at 9 am. The enthusiasm, if not the goal, was clear right away. Our married pair of interlocutors, Carla Bitcoin and Walker America gave a brief kick-off, pumping the crowd that this is the ‘fourth battle for decentralization versus state control’ and that we were there to ‘take the orange pill’, to ‘break the fiat chain’ and enter the ‘memetic future’. The memetic hit I got from these two tallish blondish folks were that some new form of fashion irony had driven Walker to walk on in a leisure suit, and that Carla’s flat hat echoed Melania’s inauguration outfit. Bitcoin has a trademark orange hue (hex F2A900), which was a constant reminder of the orange shadow being chaotically cast about at home.

To be continued

Bob‼️This is the funniest stack yet! I loved your other stuff, but this…

I am laughing out loud! I found myself taking notes…(it is after mid

Night but I am dry & not high)

I still think it’s hilarious! It could easy

be a stand up

or a podcast

You found the right tone/voice

for the subject. Thanks for exploring

then reporting🙏 I’m looking forward

to where this adventure leads.